The UK Competition & Markets Authority (CMA) is delivering on its commitment to step up its enforcement of competition law. The increase in enforcement has been steady since it started its mandate in April 2014, but recently published figures show that 2016/2017 has been particularly busy for the CMA, and businesses should take note. With the potential for even more CMA enforcement post-Brexit, the UK is becoming a key jurisdiction to consider when handling international investigations and mitigating risks.

The CMA has also taken steps to help companies improve compliance by launching compliance workshops and guidelines, as well as a brand new cartels screening tool that the CMA is encouraging procurers to use to spot signs of cartel behavior.

Competition law enforcement

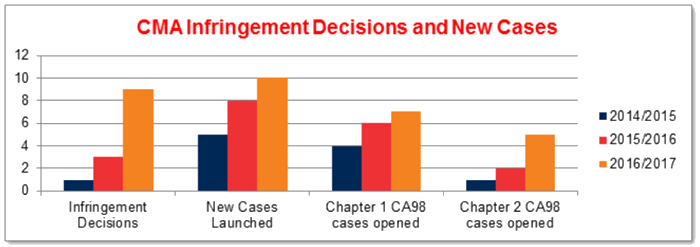

In its 2016/17 annual report, the CMA notes that it has “sharply stepped up the pace, scale and impact” of its enforcement. Recent figures attest this.

Fines imposed by the CMA between 1 April 2016 and 31 March 2017 totalled GBP 100 million, representing a large increase on the previous two years (GBP 46 million in 2015/2016 and GBP 0.74 million in 2014/2015). In addition, in December 2016 the CMA secured its first ever company director disqualification.

Furthermore, the CMA has continued to invest in its cartels capabilities by expanding the availability of Nuix (a data gathering and search tool frequently used by the CMA and the European Commission in dawn raids) within its operations.

Furthermore, the CMA has continued to invest in its cartels capabilities by expanding the availability of Nuix (a data gathering and search tool frequently used by the CMA and the European Commission in dawn raids) within its operations.

Unique new cartel screening tool for purchasers

The CMA states that it is firmly involved in promoting compliance, and recent activities illustrate this – see the CMA’s marketing campaign on “Cracking down on Cartels”, workshops/e-learning tools developed for the NHS to spot and stop problematic behaviour, and guidance published on resale price maintenance and bid rigging.

Of particular interest is the CMA’s new free cartel screening tool, which is designed to help procurers screen their tender data for signs of cartel behaviour. This is the first time an antitrust agency has offered this type of tool to purchasers. By using a system of algorithms, the tool will test for suspicious signs in 3 key areas: (i) the number and pattern of bidders; (ii) the pricing patterns; and (iii) document origin and low endeavour submissions.

The combined and weighted total gives a ‘suspicion score’ for the tender exercise, with the pass/fail threshold and weighting of each factor being adjustable in order to reflect users’ knowledge of the market, suppliers and bids (for example, if a user has a procurement framework that might make three bidders or less inevitable, the user might adjust the weighting for this factor down to zero). The suspicion score does not definitively identify the existence of a cartel, but highlights which tenders are more likely than others to be suspect. Users are encouraged to investigate suspicious results, and report suspicions of price-fixing to the CMA’s cartel hotline.

Outlook for future enforcement

The CMA’s commitment to, and the trend towards, increased enforcement comes at an interesting time. Though the outcome of Brexit remains uncertain, it is quite possible that in the near future the CMA will have full jurisdiction to pursue and enforce penalties in much larger cases, where previously the European Commission took sole jurisdiction.

Given the size of the UK economy within Europe and globally, the sophistication of the CMA as a leading competition authority, and the existence of a reliable and well-used UK leniency regime, it is likely that full immunity applications to the CMA could hit much higher levels in the run up to and post-Brexit. For companies seeking to mitigate their exposure, paying heed to the investigative expectations and demands of the CMA could become a major factor in handling future investigations and prioritising jurisdictional risks.

In particular, these developments may well change the dynamics of and procedures for running investigations in Europe, given the CMA’s expectations and interventionist approach in terms of data integrity, identifying and securing evidence, witness interviews and surveillance capabilities. The CMA’s standards in this area go beyond those of the European Commission, and align more closely to those of the US Department of Justice. Companies investigating and reporting conduct that previously might only have been pursued by the European Commission, will need to become more familiar with the CMA’s expectations on how to conduct and report on investigations that could impact on the UK.