On 9 August 2019, the Luxembourg Parliament publicly released the bill of law 7465 implementing the European Union (EU) Directive 2018/822 of 25 May 2018 on mandatory disclosure requirements for intermediaries (DAC6 or the “Directive“). These new provisions, applicable only to direct taxes, will require intermediaries and, in certain situations, the taxpayer itself to report information on cross-border arrangements to the extent these arrangements fall under at least one of the hallmarks further detailed below. The bill will have effect as of 1 July 2020, and the first reporting period will cover arrangements implemented between 25 June 2018 and 30 June 2020 (i.e., retrospective effect as to the period covered).

What are these new rules about? Please see the sections below:

1. What is required?

Intermediaries based in the EU will be obliged to submit information on reportable cross-border arrangements to the Luxembourg tax authorities.

2. Who must comply?

Intermediaries are referred as accountants, banks, tax and financial advisers, as well as consultants who design, promote or implement tax-planning schemes. Given the broad definition of “intermediaries”, the impact is not limited to tax advisers or transfer pricing experts but, arguably, it extends to any intermediary advising on (or assisting with) the design and implementation of cross-border arrangements with an EU connection. This means that non-tax professionals and non-EU professionals may also fall within the scope of the rules.

The text of the Directive offered the possibility for Member States to exempt certain intermediaries from the obligation to report. In Luxembourg, the bill of law foresees that lawyers should not be bound to report certain information that could lead to identification of their clients, but remain bound to report a certain amount of information which are detailed below. Note that in any case, the obligation to report is shifted to other intermediaries or the taxpayer itself.

When several intermediaries are required to report on the same arrangement, a Luxembourg intermediary could be exempt from filing the information if it can evidence that the same information has been filed in another Member State (e.g., the intermediary can provide written proof, delivered by the tax authorities of the other Member State, that the same information has been filed in accordance with the law of the other Member State).

3. What to report?

The information to be reported by most intermediaries (except lawyers covered by the attorney privilege) under the bill of law is the following:

- the identification of intermediaries and taxpayers, including, amongst other things, name, date and place of birth for individuals, residence for tax purposes and other relevant information;

- details of the hallmarks that make the cross-border arrangement reportable;

- a summary of the content of the reportable cross-border arrangement;

- the date on which the first step in implementing the reportable cross-border arrangement was made or will be made;

- details of the national provisions that form the basis of the reportable cross-border arrangements;

- the value of the reportable cross-border arrangement;

- the identification of the Member State of the relevant taxpayer(s) and any other Member States which are likely to be concerned by the reportable cross-border arrangement;

- the identification of any other person in a Member State likely to be affected by the reportable crossborder arrangement, indicating to which Member States such person is linked.

Lawyers covered by the attorney privilege remain bound to report the following information:

- the identification of intermediary including name, date and place of birth for individuals, residence for tax purposes and tax number;

- details of the hallmarks that make the cross-border arrangement reportable;

- a summary of the content of the cross-border arrangement;

- details of the national provisions that form the basis of the reportable cross-border arrangements.

Note that for lawyers, they will still have the possibility to report for the account of a taxpayer through a dedicated mandate.

4. What is a reportable cross-border arrangement?

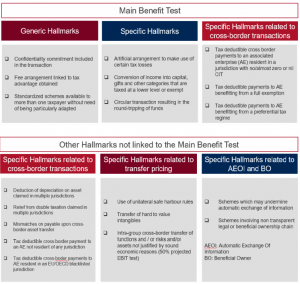

A “reportable cross-border arrangement” is referred to as any cross-border arrangement that bears one or more of the hallmarks listed below with a cross-border dimension. Certain arrangements will require the main benefit test (i.e., obtaining a tax advantage) to be met together with at least one of the hallmarks to be reportable, while other arrangements (e.g., those that fall within the specific transfer pricing hallmark) will need to be reported, even if they do not satisfy the “main benefit” test.

When it comes to interpretation of certain notions such as the main benefit test, the commentaries of the bill of law explicitly refer to the BEPS Action 12 Final Report[1]. In the latter, “the arrangement must satisfy the condition that the tax advantage is, or might be, expected to be the main benefit or one of the main benefits of entering into the arrangement. Such a test compares the value of the expected tax advantage with any other benefits likely to be obtained from the transaction and has the advantage of requiring an objective assessment of the tax benefits“.

5. When does it apply?

EU Member States are required to transpose DAC6 into national legislation by 31 December 2019 and apply the new rules as from 1 July 2020. However, the reporting obligation, applies to transactions implemented as from 25 June 2018. Intermediaries and relevant taxpayers will be obliged to submit information to the tax authorities for the first time by 31 August 2020 with respect to reportable transactions implemented between 25 June 2018 and 1 July 2020 (the first reporting period). This means that records of any potentially reportable arrangements that have occurred as from 25 June 2018 onwards should be kept. Following the first reporting period, information on reportable cross-border arrangements must be filed with the Luxembourg tax authorities within 30 days beginning on the day after the reportable arrangement is made available, or is ready for implementation, or when the first step has been implemented, whichever occurs first.

Lawyers covered by attorney privilege should notify the other intermediary or the taxpayer itself within 10 days beginning on the day after the reportable arrangement is made available, or is ready for implementation, or when the first step has been implemented, whichever occurs first.

6. What are the sanctions?

A fine of up to EUR 250,000 could be imposed in case of failure to comply with the reporting/notification obligations.

7. How to assess your situation?

[1] OECD (2015), Mandatory Disclosure Rules, Action 12 – 2015 Final Report, OECD/G20 Base Erosion and Profit Shifting Project, OECD Publishing (§81), Paris, https://doi.org/10.1787/9789264241442-en