In brief

On 20 July 2021, the UK Government announced that the National Security and Investment Act will enter into full force on 4 January 2022. To help businesses prepare for commencement of the regime, the Government also published alongside this announcement a series of further guidance notes and materials.

The NSI Act creates a new, self-standing UK investment screening regime on national security grounds, comparable to CFIUS in the US. The Act is extremely broad in its scope and powers – companies and investors, even those with limited links to the UK, should ensure that they are familiar with the new rules now, particularly since the regime applies retrospectively to deals taking place currently.

Contents

a. Key features of the regime:

a. Draft notifiable acquisition statutory instrument

b. Statement on the use of the call-in power

c. General guidance regarding the new regime

d. Guidance on how the NSI Act could affect people or acquisitions outside the UK

e. Guidance on the NSI Act alongside other regulatory requirements

f. Guidance for the higher education and research-intensive sectors

g. Comment

3. Practical insights and experience

Key takeaways

- The UK’s new investment review regime under the National Security and Investment Act will enter into full force on 4 January 2022. The regime significantly expands the UK Government’s existing powers to screen investments on national security grounds.

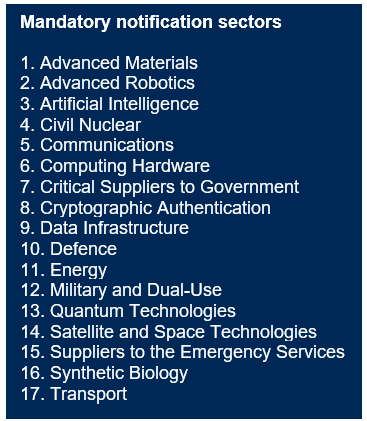

- From 4 January 2022, a mandatory notification regime under the Act will be in force for acquisitions in 17 key sectors, while it will also be possible to submit voluntary notifications outside these sectors. Notifications will be submitted to the Government’s Investment Security Unit via a new online portal.

- From this date, the Government will also be able to “call in” transactions for in-depth review where it reasonably suspects they give rise to a risk to national security, including in respect of transactions that have closed since 12 November 2020. At the end of an assessment period, the Government will either clear, impose conditions on, or unwind or block an acquisition.

- The jurisdictional criteria in the Act are extremely broad, and the Act catches the acquisition of intangible assets such as IP, certain non-UK transactions and even internal corporate reorganizations.

- Non-compliance with the mandatory regime risks significant criminal and civil sanctions, while mandatorily notifiable investments that complete without being cleared under the Act will be void.

- Further guidance is expected ahead of commencement of the regime, including in relation to the 17 mandatory notification sectors. Other aspects of the new system, such as the content of the notification form, also need to be finalized before the regime goes “live”.

- Companies and investors should ensure that they are familiar with the new rules now, given the broad scope of the mandatory notification system and risk of retrospective call-in under the Act.

In depth

What is the NSI Act?

The long-anticipated National Security and Investment Act 2021 (“NSI Act” or “Act“) was introduced by the UK Government before Parliament in Bill form on 11 November 2020. The Act creates a new, self-standing UK investment review regime, comparable to CFIUS in the US, enabling national security screenings of acquisitions of control over qualifying entities or assets. This is a significant expansion of the UK Government’s existing national security review powers under the Enterprise Act 2002 (“Enterprise Act“), which are closely related to the UK merger control rules and will be repealed upon commencement of the NSI Act regime.

Key features of the regime:

- The NSI Act regime applies to acquisitions of control over qualifying entities (covering a range of legal structures, including companies, limited liability partnerships and trusts) and qualifying assets (covering both tangible assets such as land or moveable property, and intangible assets such as IP).

- The regime has a very broad UK nexus test. Non-UK based target entities can be caught where they (a) carry on activities in the UK or (b) supply goods or services to persons in the UK. Assets outside the UK are covered if they are used in connection with the carrying on of activities in the UK or the supply of goods or services to persons in the UK.

- Unlike the Enterprise Act regime, the NSI Act does not have any turnover or share of supply jurisdictional thresholds below which a transaction cannot be challenged. Instead, the following “trigger events” will be deemed to give rise to an acquisition of control capable of being reviewed under the regime:

- acquisitions of shares or voting rights (a) from 25% or less to more than 25%, (b) from 50% or less to more than 50%, or (c) from less than 75% to 75% or more;

- acquisitions of voting rights that enable the acquirer to secure or prevent the passage of any class of resolution governing the affairs of the target;

- acquisitions enabling the acquirer materially to influence the policy of the target; or

- acquisitions of a right or interest in, or in relation to, a qualifying asset enabling the acquirer (a) to use the asset, or use it to a greater extent than prior to the acquisition, or (b) to direct or control how the asset is used, or direct or control how it is used to a greater extent than prior to the acq

uisition.

uisition.

- The Act establishes a mandatory notification regime for qualifying entity transactions in 17 sensitive sectors of the economy (see Box), which will be void if not cleared prior to closing. Voluntary notification of transactions will also be possible outside these sectors, although such transactions will only be prohibited from closing pending review if this is stipulated by an interim order from the Government.

- Notifications will be submitted via a new online portal to the Investment Security Unit (ISU), the UK Government body responsible for conducting screenings and administering the NSI Act regime. Final decisions will rest with the Department for Business, Energy and Industrial Strategy (BEIS).

- The Government will have the power formally to “call in” qualifying transactions that it reasonably suspects may give rise to a risk to national security for in-depth review. It will be able to do so both in relation to notifications made to it and proactively, regarding transactions in the wider economy. Asset acquisitions will not be mandatorily notifiable, but can still be called in if they could give risk to a national security risk.

- Broadly, the Government will have 5 years to call in transactions, reduced to 6 months where the Government is aware of a transaction. Subject to these time periods, tThe Government will also be able to retrospectively to call in transactions that have closed between 12 November 2020 and commencement of the regime on 4 January 2022, subject to these time periods which will run from commencement. Proactive disclosure of sensitive transactions which have closed or will close during this period should be considered as this will reduced the call-in limitation period to 6 months rather than 5 years from 4 January 2022.

- The initial screening period following mandatory notification will be 30 working days from the point the ISU accepts a notification (the Government expects to clear a majority of notified investments within this period). Where a transaction outside the mandatory notification sectors or following the initial screening period after mandatory notification is called in, the national security assessment period will also be 30 working days, with the possibility of an additional 45 working days (and further extensions beyond this subject to agreement with the acquirer).

- Following its assessment, when clearing a transaction, the Government can impose conditions that it reasonably considers are necessary and proportionate to prevent, remedy or mitigate any identified national security risk. Such conditions may include, for example, restricting permitted share ownership levels or controlling access to commercial information or sensitive sites. As a last resort, the Government may also prohibit or unwind transactions.

- Non-compliance with the regime risks significant criminal and civil sanctions. Acquirers who fail to submit a mandatory notification can face financial penalties (up to 5% of total worldwide turnover or £10 million, whichever is higher) and criminal liability for directors.

What has changed?

Minimal changes were made to the Bill during the UK Parliamentary process. The Bill enjoyed broad cross-party support. The only significant amendment in this process was the removal of a separate 15% notifiable event threshold from the Act’s jurisdictional provisions. Reporting requirements around the regime were also strengthened, with parliamentarians successfully pushing the Government to submit annual reports with details of how the new regime in operating in practice, for example, setting out the average number of working days from notification to a decision to accept or reject a notification.

The UK Government has also consulted both formally and informally on various aspects of the regime. In particular, the definitions of the 17 mandatory notification sectors, and the content of the notification form, have been subject to an intense consultation process.

On 20 July 2021, the UK Government announced that the NSI Act will enter into force on 4 January 2022. To help businesses and investors prepare for commencement of the regime, the Government published alongside this announcement a series of further guidance notes and materials, as follows:

Draft notifiable acquisition statutory instrument

- Refines further the 17 sectors of the economy in which qualifying investments will be subject to mandatory notification requirements.

- These regulations were published formally on 7 September 2021 in the form of the National Security and Investment Act 2021 (Notifiable Acquisition) (Specification of Qualifying Entities) Regulations 2021, ahead of their commencement alongside the rest of the NSI Act regime on 4 January 2022. We also understand that the Government is intending to issue further guidance regarding the mandatory sectors.

Statement on the use of the call-in power

- This is the draft version of the formal statement, pursuant to Section 3 of the NSI Act, setting out how the UK Government expects to exercise its call-in power.

- The Government sought views on the draft content of this statement in a further consultation process.

General guidance regarding the new regime

- Sets out how parties should prepare for commencement of the NSI Act regime, covering (i) what types of acquisitions are covered by the new rules, (ii) in what circumstances parties will need to inform the Government about an acquisition, and (iii) how the Government will scrutinise acquisitions.

Guidance on how the NSI Act could affect people or acquisitions outside the UK

- Sets out (i) what types of acquirers and acquisitions outside the UK are covered by the NSI Act, (ii) common circumstances that would put an acquisition in scope of the NSI Act, and (iii) examples of how the rules may affect parties based outside the UK.

Guidance on the NSI Act alongside other regulatory requirements

- Provides further information regarding how the NSI Act will interact with the following regulators and codes: (i) Enterprise Act, (ii) Competition and Markets Authority, (iii) Export Control Joint Unit, (iv) Takeover Code, (v) Financial Conduct Authority and (vi) Prudential Regulation Authority.

Guidance for the higher education and research-intensive sectors

- Provides guidance for higher education institutions, other research organisations and investors in this area to understand the scope of the NSI Act and how to prepare for the new rules.

Comment

- While these materials and guidance notes do not introduce significant new points (as expected, given that the Act was enacted in April), they nonetheless include some useful comments, while in many respects also underlining further the considerable breadth of the NSI Act regime.

- The guidance confirms the flexibility of the Act’s jurisdictional criteria – for example, indicates that a non-UK based entity can be caught as a qualifying entity under the regime where it merely supplies goods that pass through the UK while traveling to other destinations. The guidance also expressly confirms that internal reorganisations are within the scope of the Act.

- The same three factors determining call-in risk – target risk, acquirer risk and control (previously trigger event) risk – continue to be referred to in the updated guidance, which also clarifies that an acquisition may be called in if any one of these factors raises the possibility of a risk to national security. The Government expects to call in asset acquisitions “rarely and significantly less frequently than acquisitions of entities”. However, there will be a greater risk regarding assets in the 17 sensitive sectors. There are also indications that the Government is more likely to be concerned about and call in transactions “closely linked” to the 17 sensitive sectors.

- Acquisitions of qualifying entities and assets that are outside the UK are also deemed to be generally less likely to give rise to national security risks than those located within the UK.

- Interestingly, the guidance refers to threats to the UK’s “reputation or economic prosperity” in the context of assessing the acquirer risk posed by an investment. Despite UK Government statements to the contrary, this appears to conflate industrial policy concerns with national security assessments under the NSI Act.

- The Government has indicated that it will publish further guidance ahead of commencement of the regime, including in relation to the trigger event thresholds under the NS&I Act for notifiable acquisitions.

Practical insights and experience

- The Government has been keen to stress throughout the passage of the NSI Act that the UK remains open for foreign investment. However, the risk remains of national security issues being conflated with industry policy factors in assessments carried out under the Act.

- While its intervention and assessment practice under the regime remains to be seen, it is to be hoped that the Government will call in for review only a very small proportion of deals genuinely harmful to national security, speedily clearing all other notified investments. Prior to commencement of the regime, it has been possible for businesses and their advisers to engage informally with the UK Government regarding whether specific transactions are likely to cause national security concerns under the Act.

- Our experience to date of dealing with the ISU – whether clarifying elements of the regime or obtaining informal views on specific transactions – has been largely positive. We have found the ISU to be generally responsive, receptive to considered points made to it and committed to helping investors and companies adjust to the new regime. While we await the reality of the regime in practice following its commencement, this bodes (cautiously) well for formal interactions with the ISU after 4 January 2022.

- To date there has been a generally cautious approach taken by parties and advisers around the need to notify the ISU about transactions, given the Act’s very broad jurisdictional criteria and draconian penalties and consequences of non-compliance. We expect this approach to continue after 4 January 2022 leading to a material volume of voluntary notifications being submitted as well as a conservative approach being taken to what is included in the mandatory notification sectors, particularly in the early stages of the regime.

- We have also seen approaches develop around NSI Act risk mitigation and conditions precedent in transaction documentation, even before commencement of the regime, given the potential retrospective application of the call-in power. This will continue, particularly once the regime has entered into full force, and we see NSI Act risk becoming a key negotiation point in affected transactions in the same way that merger control has been for decades.

- Moving forwards, it will be important for the UK Government to provide as much further clarity as possible to companies and investors ahead of commencement of the regime. For cross-border transactions involving multiple filings, it will also be crucial for parties and their advisers to coordinate NSI Act processes with other foreign investment approval procedures globally so that substance is consistent and timetables are synced.

How we can help

- Baker McKenzie’s Foreign Investment Review team has substantial expertise in liaising with UK Government stakeholders and advising a range of clients on all aspects of the NSI Act. Stay tuned to our Foreign Investment and National Security Blog for the latest updates and developments, and please do contact a member of our team directly if you have any questions regarding the implications of the NSI Act for your current and future transactions.