In brief

In a recent interview Mr. Anutin Charnvirakul, the Minister of Public Health, lauded the many community enterprises all over Thailand which have been growing cannabis for hospitals to extract for medical purposes and the hundreds of medical cannabis clinics all over the country which have proven to be very popular with the Thai people. The Minister was pleased with how Thai people have embraced cannabis and has again stressed his mission to make cannabis both a cash crop, as well as a medicine, for the nation. He also mentioned intended efforts to continue with liberalizing the laws and regulations on cannabis even further to increase access to cannabis.1

Rising demand for hemp owing to its medicinal and dietary benefits is driving the growth of the hemp industry globally across sectors, including pharmaceuticals, food and beverages, and cosmetics. The global industrial hemp market size was valued at USD 3.61 billion in 2020 and is expected to reach USD 12.01 billion by 2028. Robust growth in this sector has been observed domestically with hemp attracting significant interests from large Thai conglomerates to smaller startups alike. Krungsri Research had forecasted that the Thai market for hemp will have a value of THB 15.77 billion (over USD 480 million) by 2025.2

As we welcome various favorable policies and supporting rules and regulations from the government and relevant government agencies, as well as legislative efforts to push the medical cannabis and hemp industry forward in Thailand, one issue which can be explored in more detail is what this means for foreign investors in this industry.

The followers of this industry may have heard discussions around how the Thai government may be trying to protect the cannabis and hemp industry for the Thai people first. Some may also be aware of the two-thirds local director and shareholding requirement for an applicant for a hemp manufacturing (growing and non-growing) license. But there is much more to these discussions in terms of the multitude of opportunities in the other parts of the cannabis and hemp segments, which we will highlight in our article today.

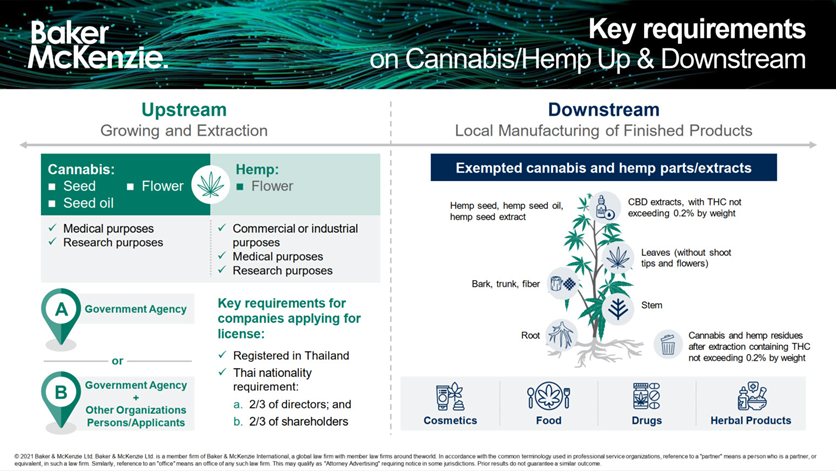

We wanted to illustrate this point with the infographic below which depicts the upstream and downstream segments of the cannabis and hemp market.

Click to view full size

As can be seen in the infographic, the parts/extracts of the cannabis and hemp plants which we refer to as “exempted cannabis and hemp parts/extracts” can be used to produce various finished products that have potential for growth in the market. The manufacturing of these finished products (i.e., cosmetics, food products and drugs) can be done by foreign majority owned companies in Thailand with the relevant manufacturing and product licenses.

In addition, there are also various other ancillary and supporting businesses in the cannabis and hemp space that offer opportunities for foreign companies wishing to benefit from the rising demand for these products and services, including laboratory tools for testing cannabis and hemp, and extraction equipment.

A promising piece of legislation in the pipeline for medical cannabis is likely to spur this favorable environment further. The Thai Cabinet has recently approved a draft ministerial regulation on the application for and the issuance of the license for the manufacture, import, export, sale or possession of cannabis. The draft will need to be approved and signed by the Minister of Public Health before publication in the Government Gazette to become effective, but this marks another exciting development.

The draft regulation is aimed at providing clarity on the implementing framework regarding the rules, procedures and conditions for the application and issuance of the manufacturing, import, export, sale and possession licenses for cannabis for medical and research purposes, including who can apply for these licenses. An interesting aspect of the draft regulation is that it contemplates allowing holders of a modern drug manufacturing license (among others, if the requirements are met) to be able to apply for a license to manufacture cannabis (that is not growing, e.g., extraction) and import or export cannabis for medical use. Hospital operators and holders of a modern drug selling license (among others, if the requirements are met) will also be able to apply for a license to sell cannabis for medical use. Holders of these modern drug licenses and hospital operators can potentially be private companies as well.

As the regulations on cannabis and hemp continue to develop and the regulator’s policies are progressing towards greater relaxation, we expect to see the private sector taking up even more of the market share in this fast growing industry. As major foreign players continue to keep a close eye on the developments of the industry in Thailand, we anticipate that foreign investors may play a major role in the various segments of the medical cannabis and hemp market as well.

1 Reference news article on Minister of Public Health’s interview: อนุทิน_ลุยนโยบายกัญชา_วางเป้า_ทลายทุกข้อจำกัด.pdf (datasrvr.com)

2 Reference Krungsri Research