In brief

The Superintendent of the Venezuelan Tax Authority (SENIAT) issued Administrative Ruling No. SNAT/2023/00005 (“Ruling“)1, which designates who may be designated as a special taxpayer, their obligations and other relevant aspects. The Ruling repealed Administrative Ruling No. SNAT/2007/06852 and entered in force on 15 March 2023.

Contents

In depth

On 14 March 2023, the Superintendent of SENIAT issued Administrative Ruling No. SNAT/2023/00005, published in Official Gazette No. 42,588 on the same date.

The following are the most important aspects of this Ruling:

1. Designation of special taxpayers: The Venezuelan Tax Authority shall have the power to designate special taxpayers (‘ST’). The following individuals/legal entities may be designated as ST:

In brief

The Superintendent of the Venezuelan Tax Authority (SENIAT) issued Administrative Ruling No. SNAT/2023/00005 (“Ruling“)1, which designates who may be designated as a special taxpayer, their obligations and other relevant aspects. The Ruling repealed Administrative Ruling No. SNAT/2007/06852 and entered in force on 15 March 2023.

Contents

In depth

On 14 March 2023, the Superintendent of SENIAT issued Administrative Ruling No. SNAT/2023/00005, published in Official Gazette No. 42,588 on the same date.

The following are the most important aspects of this Ruling:

1. Designation of special taxpayers: The Venezuelan Tax Authority shall have the power to designate special taxpayers (‘ST’). The following individuals/legal entities may be designated as ST:

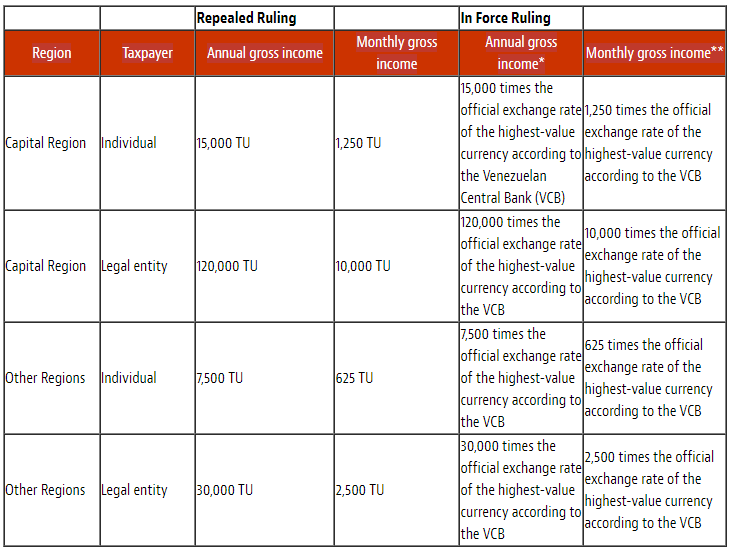

*In accordance with the last income tax return

** As reported in the last six value added tax returns

One of the most relevant amendments is the substitution of the Tax Unit (TU), which served as a parameter to designate an individual or legal entity as an ST, for the exchange rate of the highest-value currency published by the VCB.

The following persons may also be designated as ST, regardless of their tax domicile:

- Those engaged in primary, industrial and transportation activities of hydrocarbons or the commercialization of hydrocarbons and their derivatives for export

- Those engaged in hydrocarbon operations or related activities due to operating agreements of exploration and exploitation at risk under the Profit Sharing Scheme or strategic associations

- Shareholders, main suppliers and holders of joint ventures engaged in primary, industrial and transportation activities of hydrocarbons or the commercialization of hydrocarbons and their derivatives for export

- Those who carry out operations in the exploitation, exploration, processing, industrialization, transportation, distribution and internal and external trade of natural gas

- Those engaged in mining activities or any related activity

The following persons cannot be designated as ST: (i) those that have been incorporated within the framework of new businesses — such exclusion shall only be applicable for a period of two years after registration in the National Entrepreneurship Registry; (ii) those that are exclusively engaged in the primary exploitation of agricultural activities in certain sectors (i.e., vegetable, aviculture, livestock, forestry, fishery and aquaculture); (iii) community-based organizations; (iv) organized communities; (v) all instances of the people’s power that comply with the requirements established in the Ruling; and (vi) taxpayers that have been in commercial operation for less than a year unless they are engaged in activities carried out by financial institutions, insurance and reinsurance companies, and those related to construction activities and/or if the Tax Administration verifies that they comply with articles 2 or 3 of the Ruling.

2. Duties

- ST must file their returns electronically within the established timeframe.

- The returns must be filed and paid in accordance with the Special Taxpayers’ Calendar in force3.

- They shall file their appeals or carry out any formalities at the address indicated in the respective ST’s notification letter.

3. Other relevant aspects:

- Individuals will lose their ST status upon their death.

- Legal entities will lose ST status upon cessation of operations and liquidation.

- In the event that the ST change their domicile, they must notify the Tax Administration within a maximum period of one month after the change.

- Taxpayers that cannot be designated as special taxpayers and that have been designated as such prior to the entry into force of the Ruling may lose such status following the procedure established in the Ruling.

We remain at your disposal in case you require further details or explanations on the general aspects highlighted in this report.

Click here to access the Spanish version.

1 Published in Official Gazette No. 42,588 on 14 March 2023.

2 Published on Official Gazette No. 36,622 on 8 February 2007.

3 Special Taxpayers’ Calendar 2023, published in Administrative Ruling SNAT/2022/000068 of SENIAT. Published in Official Gazette No. 42,515 of 29 November 2022.