In brief

Law Number 4 of 2023 on the Development and Strengthening of the Financial Sector (“P2SK Law“) has placed OJK in a more central position to investigate crimes in the financial services sector. As an implementing rule, OJK has issued Regulation Number 16 of 2023 on Investigation of Crimes in the Financial Services Sector (“OJK Reg 16/2023“) which covers, among other things, the general scope of crimes in financial services sector, members of authorized teams of investigators, the investigative authorities and powers, and available alternative settlement mechanics.

Crimes in financial services sector

Under OJK Reg 16/2023, OJK has the power to investigate crimes in the financial sector, including in:

- Banking

- Carbon exchanges, capital market and derivative finance

- Multifinance companies, venture capital companies, microfinance companies

- Other companies classed as financial services companies under the prevailing laws

This investigative power applies to conventional and sharia financial services.

OJK’s investigation team and its authorities

The OJK’s investigation team is a joint agency appointed by a decree of OJK’s board of commissioners, which consists of officials from:

- The Police of the Republic of Indonesia (“Police“)

- Civil servant investigators appointed by the Minister of Law and Human Rights

- OJK officials that fulfil the qualifications set by the Police of the Republic of Indonesia

The team is authorized and responsible for, among other things:

- Receiving reports, notifications or complaints from any person on crimes in the financial services sector

- Summoning, searching and requesting testimony or evidence from any suspect

- Examining books, records and other relevant documents

- Requesting assistance from the police or other government agencies in conducting any arrest, detainment, search, and confiscation

- Conducting searches in any particular place where it is suspected that there is evidence of bookkeeping, records and other documents and confiscating items that can be used as evidence

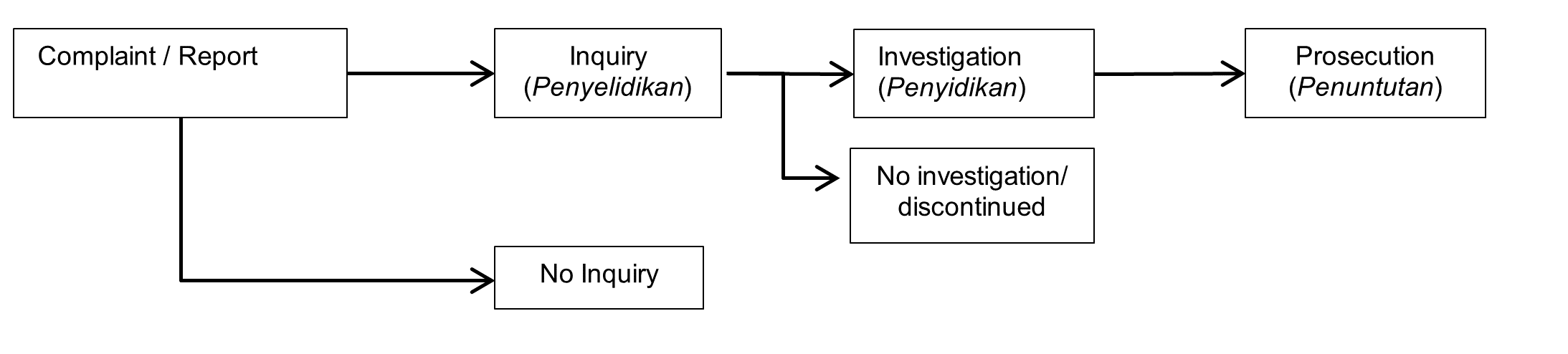

Under OJK Reg 16/2023, OJK, at its discretion, may decide whether to launch an inquiry (penyelidikan) over suspected crimes based on a report, notification or complaint. Once the inquiry is completed, OJK may proceed with an investigation (penyidikan). During the investigation, OJK by coordinating with the Police will build up the case and gather evidence for the prosecution (penuntutan). Finally, OJK will hand over all evidence and case materials to the public prosecutor (jaksa) for further prosecution after the investigation. Please see below a flowchart that generally describes the framework:

Public monitoring and report

There is no restriction as to who may file a report, notification or complaint to OJK on any suspicion of crimes in the financial services sector. The reporting party may request updates from OJK on the development of the case. Those requests are possible once OJK decides to launch an investigation into the reported issue.

Alternative settlement of criminal charges

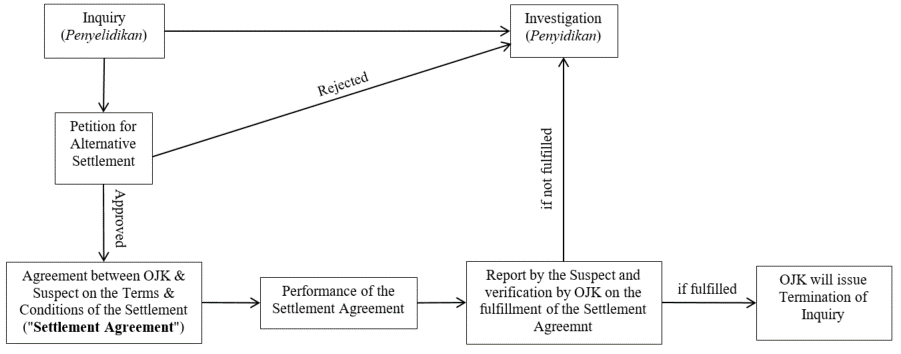

Under OJK Reg 16/2023, a person suspected of criminal activity in financial services may propose to settle the criminal charges through an alternative settlement process. The process is governed by Chapter IV of OJK Reg 16/2023, which is depicted in the following flow chart:

During the inquiry (penyelidikan) by OJK, a suspect may submit a petition to settle the potential criminal charges (“Petition“) that contains (i) an estimate of the loss incurred, (ii) information on the victims, (iii) the proposed forms and timeframe of reparation and (iv) a statement of commitment to improve the suspect’s business process and governance. Once the Petition is deemed complete, the Petition will be inspected by OJK using three criteria: (i) the rehabilitative effect of the Petition towards the incurred loss, (ii) the value proposed in the Petition and (iii) the impact of the settlement in the Petition towards the general outlook of the financial services industry and the public interest. OJK will issue a decision on the Petition at the latest 30 working days after the Petition is deemed complete. If the Petition is rejected, OJK will explain the reason for the rejection and may escalate the case to investigation.

If a Petition is approved, it will be formalized into an agreement between OJK and the suspect, incorporating the terms of the reparation and, if applicable, any corrective actions deemed appropriate by OJK (for example, administrative sanctions). The reparation paid for the settlement will be distributed among the victims. The reparation could be in cash or, with the victim’s consent, in-kind assets. The payment of the reparation will be followed by statements from the victim, waiving their rights to initiate legal proceedings. The suspect must completely perform the terms of the settlement in accordance with the settlement agreement, which, in any case, must not take more than one year after the settlement agreement is signed. The suspect will bear all fees related to the settlement.

Once the suspect has executed all settlement agreement terms, it must submit a report to OJK. In the report, the suspect must elaborate and provide evidence on the completion of the settlement. OJK will verify the report and determine if the performance is completed. OJK is authorized to escalate the case into investigation (penyidikan) if any of the settlement terms are not fulfilled.

Other highlights: money laundering investigation and account freezing

OJK also has the authority to also investigate money laundering cases related to crimes in the financial services sector. For this investigation, OJK may cooperate with the Center for Financial Transaction Reports and Analysis (Pusat Pelaporan dan Analisis Transaksi Keuangan).

In conducting the investigation, OJK may request information from financial services institutions on the financial condition of a suspect or instruct the relevant financial services institution to block accounts owned or related to the suspect. The relevant financial services institution must comply with OJK’s request, or it will face sanctions in accordance with the prevailing laws.

* * * * *

© 2023 HHP Law Firm. All rights reserved. HHP Law Firm is a member firm of Baker & McKenzie International. This may qualify as “Attorney Advertising” requiring notice in some jurisdictions. Prior results do not guarantee a similar outcome.