Tax News and Developments October 2023

In brief

With the new year comes the 1 January 2024 effective date of the Corporate Transparency Act (CTA), which will require approximately 32.6 million US entities to report beneficial ownership information (BOI) to the Treasury’s Financial Crimes Enforcement Network (FinCEN). On 28 September 2023, FinCEN published proposed regulations modifying the BOI Reporting Requirements (“Proposed Regulations“), which are found in the CTA’s implementing regulations. In our prior client alert, Beneficial Ownership Reporting, Part III, we summarized the CTA’s implementing regulations. The only change in the Proposed Regulations is a temporary extension of time for newly-formed “Reporting Companies” to register their BOI for calendar year 2024. Below we provide a high level overview of the BOI Reporting Requirements in the United States.

When must entities meet the CTA’s BOI Reporting Requirements?

Existing Entities: Reporting companies existing before 1 January 2024 must file their initial reports regarding Beneficial owners under the CTA with FinCEN by 1 January 2025.

New Entities: Reporting companies formed after 1 January 2024 and before 1 January 2025 must file initial reports regarding Company Applicants within 90 days of formation or registration under the Proposed Regulations. Reporting companies formed after 1 January 2025 will only have 30 days to report this information.

Changes in BOI: Changes in beneficial ownership must also be reported within 30 days of the change.

What entities are affected by the CTA?

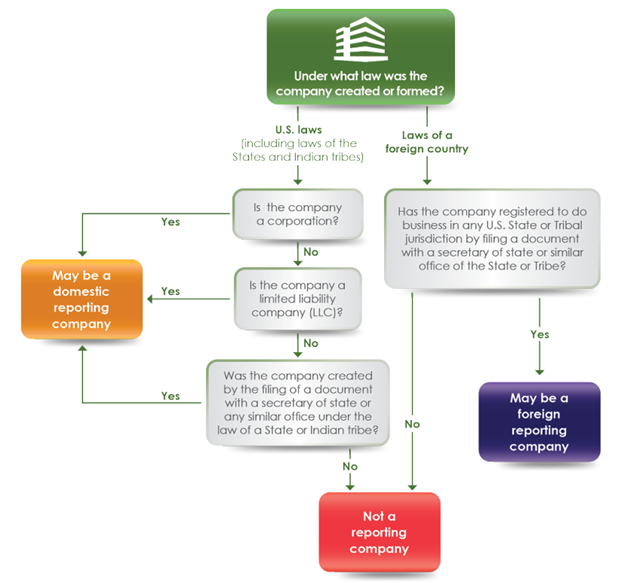

Domestic Reporting Companies: A domestic Reporting Company is a corporation, LLC, or an entity that is created by the filing of a document with a Secretary of a US State or any similar office under the law of a State or Indian Tribe. Common law trusts are not created by such filings and are not Reporting Companies.

Foreign Reporting Companies: A foreign Reporting Company is a corporation, LLC, or other entity formed under the law of a foreign country and registered to do business in any State or tribal jurisdiction by the filing of a document with a secretary of state or any similar office under the law of a State or Indian Tribe.

See Appendix: FinCEN Flowchart, below.

Are any entities exempt from the reporting obligations?

Yes, there are 23 exemptions. Among others, the following entities are exempt from the CTA’s reporting obligations:

- Certain large entities that are highly regulated and are already reporting BOI to a governmental authority (e.g., banks, publicly traded companies, registered broker-dealers, certain insurance companies, accounting firms registered under §102 of the Sarbanes-Oxley Act of 2002, etc.)

- Exempt organizations under section 501(c)

- Large operating companies employing more than 20 employees, with gross receipts or sales over USD 5 million and physical presence in the United States

- Certain entities that are entirely owned by one or more other exempt entities (“Subsidiary Exemption“)

- Certain inactive entities that were in existence before 1 January 2020 (unless owned by a “foreign person”, directly or indirectly, wholly or partially)

Nonetheless, a Reporting Company must report its own Beneficial Owners, even where a Beneficial Owner is an exempt entity. The Reporting Company must report either the names of the individuals who control directly or indirectly the exempt entity or the exempt entity itself.

What is the test for beneficial ownership?

Beneficial Owners include any and all individuals who directly or indirectly (i) own or control at least 25% of the ownership interests and/or (ii) exercise substantial control over the Reporting Company.

Substantial Control: Indicators of “substantial control,” are defined very broadly and include, but are not limited to:

- Serving as a senior officer (such as President, CEO, CFO, COO, or GC)

- Power to appoint or remove any senior officer or a majority of the board

- Ability to direct important decisions of the Reporting Company

Ownership Interest: An ownership interest includes:

- Equity, stock or voting rights interest (vote or value), including preorganization certificate or subscription

- Capital or profit interest (value)

- Instrument convertible to the above, any future on such instrument

- Warrant or right to purchase, sell, or subscribe to the above

- Debt interests if they enable the holder to exercise the same rights as holders of these specified equity or other interests, including a conversion right

- Other instrument, contract, arrangement, understanding, relationship, or mechanism used to established ownership

Ownership interests or substantial control by an individual through a trust or similar arrangement can also cause the person to be treated as a Beneficial Owner.

Exceptions: The following individuals will not be considered beneficial owners:

- Minor children

- Nominees, intermediaries, custodians, or agents

- Employees

- Creditors

- Individuals holding future interests by right of inheritance (with regard to future interests only; once interests are inherited, the person inheriting the interests become reportable)

What must be reported?

The CTA and the Final Regulations require that the Reporting Company disclose specific information about itself, its Beneficial Owners and its Company Applicant. For each Reporting Company, the Reporting Company must report its:

- Name (including d/b/a)

- Business Address

- Jurisdiction of formation

- Unique identification number

For each Beneficial Owner and Company Applicant, the following information is required to be submitted to FinCEN:

- Legal name

- Date of birth

- Current residential address for Beneficial Owners, and either business address for professional Company Applicants or residential address for other Company Applicants

- Unique identifying number from an acceptable identification document

Alternatively, instead of certain of this information on the Beneficial Owner and Company Applicant, only a FinCEN identifier may be reported to FinCEN by the Reporting Company. The FinCEN identifier is a unique identifying number that FinCEN will issue to individuals or Reporting Companies upon request starting in 2024.

What is the penalty for failure to comply?

The CTA imposes civil penalties of up to USD 500 per day or criminal penalties of up to maximum of USD 10,000 and/or possible imprisonment of up to two years. For a penalty to apply, the person must willfully provide, or attempt to provide, false or fraudulent information or willfully fail to report, complete or update BOI. Senior officers of the Reporting Company may be held accountable for that failure as well as other persons willfully causing the Reporting Company not to file a required BOI report or to report incomplete or false BOI (including providing a fraudulent identifying document copy).

A safe harbor (i.e., no civil or criminal penalties) may apply if a person has reason to believe a submitted report contained inaccurate information and within 90 days “voluntarily and promptly” submits a corrected report. However, the safe harbor is not available if the person knowingly submitted false information in the first report.

Is BOI publicly available?

No. BOI must be collected on a secure, nonpublic database and IT systems must be the “highest security level.” Further US government employees are generally banned from disclosing BOI.

FinCEN may disclose certain BOI in limited circumstances to a specific group of recipients, including:

- Federal, state, local, and tribal government agencies

- Foreign requesters, including foreign law enforcement agencies, judges, prosecutors, central authorities, and competent authorities

- Financial institutions that certify the request is in compliance with customer due diligence (CDD) requirements and the reporting company has given written consent

- Federal functional regulators and other appropriate regulatory agencies acting in a supervisory capacity evaluating financial institutions for compliance with CDD requirements

- Other agencies within US Treasury

* * *

For more on the key trends affecting the tax transparency landscape, please see our recent client alert Tax Transparency by Default – What Businesses Need to Know.

Appendix: FinCEN Flowchart