In brief

On 25 January 2024, the State Council of the People’s Republic of China (中华人民共和国国务院) promulgated the Interim Regulations on Administration of Carbon Emissions Trading (碳排放权交易管理暂行条例, “Regulations“), which will come into force on 1 May 2024.

The Regulations set out the regulatory regime over carbon emission allowance (CEA) in the mandatory carbon market, while the Administrative Measures for Voluntary Trading of Greenhouse Gas Emission Reduction (Trial) (温室气体自愿减排交易管理办法(试行)), effective from 19 October 2023, regulate the China Certified Emission Reduction (CCER) in the voluntary carbon market.

In depth

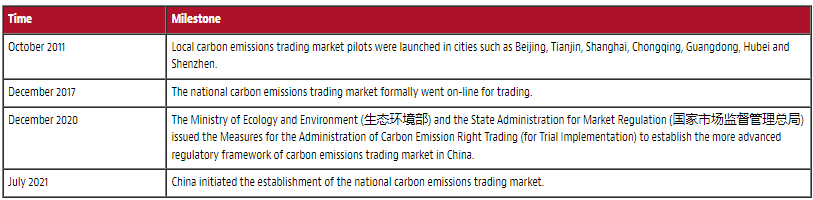

China’s carbon emissions trading market

China has been forming and developing its carbon emissions trading market over the years, with the following key milestones.

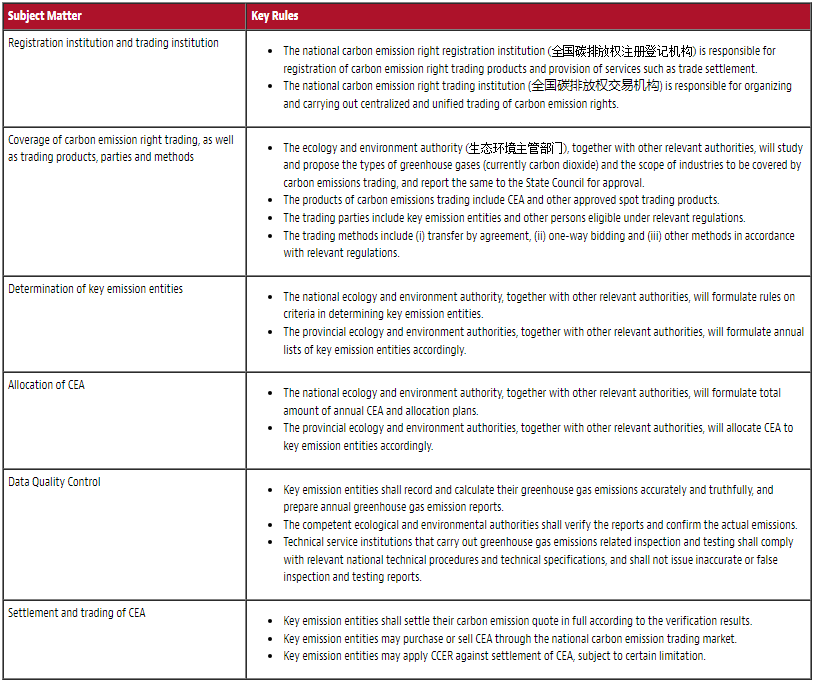

Regulatory regime for carbon emissions trading under the Regulations

Highlights of the Regulations include the following:

Remarks

The operation and administration of the national and local carbon emissions trading markets had long been based on rules issued by relevant departments of the State Council which are of relatively lower hierarchy. The Regulations constitute the fundamental administrative regulations for China’s carbon market, which will pave the way for further steady development of China’s carbon emissions trading system. While details are still contingent upon implementation rules to be issued, the Regulations will function as an important legal tool for controlling and reducing carbon dioxide and other greenhouse gas emissions through market mechanisms, and helping to actively and steadily promote carbon peak and carbon neutralization.

© 2024 Baker & McKenzie FenXun (FTZ) Joint Operation Office. All rights reserved. Baker & McKenzie FenXun (FTZ) Joint Operation Office is a joint operation between Baker & McKenzie LLP, and FenXun Partners, approved by the Shanghai Justice Bureau. In accordance with the common terminology used in professional service organisations, reference to a “partner” means a person who is a partner, or equivalent, in such a law firm. This may qualify as “Attorney Advertising” requiring notice in some jurisdictions. Prior results do not guarantee a similar outcome.