On 9 June 2022, Joint General Resolution No. 5205/2022 of the Federal Tax Authority and the National Mining Secretariat was published in the Official Gazette. Such resolution repeals Joint General Resolution 4428/2019 and sets the new regulatory framework applicable to subjects that have borne, in a fiscal year and in national jurisdiction, a total tax and/or tariff burden higher than what would have corresponded for being beneficiaries of the tax stability provided in Article 8 of the Mining Investment Law, and wish to request the refund or crediting of the amounts paid in excess according to the provisions of paragraph c) of Article 4° of Annex I of Decree No. 1,089 of 7 May 2003.

On 27 May 2022, the OECD released a new public consultation document presenting A Tax Certainty Framework for Amount A which will be the subject of this alert. Concurrently, a separate public consultation document dealing with Tax Certainty for issues related to Amount A was published, which is the focus of another alert. With these two new documents, the OECD has now released 7 out of 13 building blocks forming Amount A under Pillar One.

By means of Decree 293/2022 published on the Official Gazette on 2 June 2022, the Executive Branch ruled the tax on online gambling.

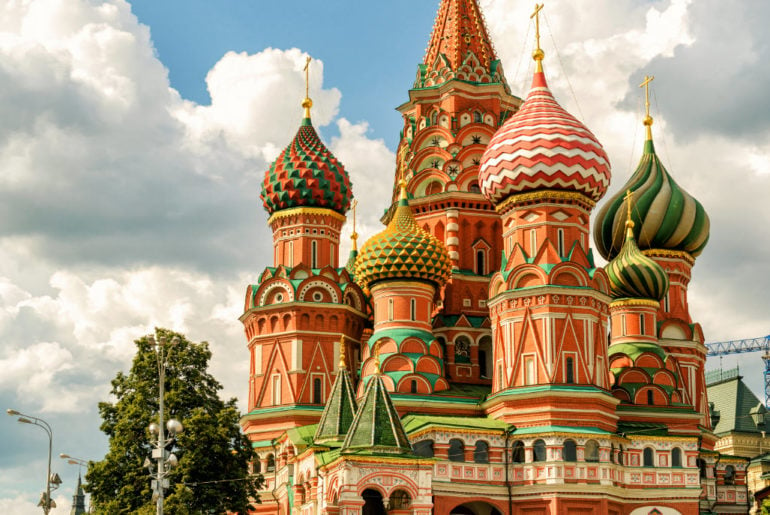

Baker McKenzie attorneys Paul Melling, Roman Butenko and Oleg Tkachenko contributed two articles to GIR – Europe, Middle East and Africa Investigations Review 2022 Digital Edition. The first article provides an overview of recent corporate anti-bribery enforcement trends and, taking into account those trends, tries to sum up the most important lessons to be learned by companies that strive to build compliant businesses in Russia. The second article is dedicated to key issues on compliance programs and their enforcement in Russia. The article provides an overview of recent anti-bribery and legislative corruption measures and the guidance provided to the Russian business community with regard to those measures and their enforcement.

We are pleased to invite you to our Virtual Global Trade Conference on July 20 and 21. In lieu of our annual conference in Bellevue, WA, we are excited to again provide a virtual offering available to all our clients and friends worldwide! Please join our international trade compliance lawyers from around the world as they discuss and examine the major developments impacting international trade. The conference will be comprised of 75 minute sessions over the course of two days and clients will also get the opportunity to request a virtual one-to-one meeting with our International Trade attorneys to discuss relevant topics of interest. Visit our events page for more information and to register.

Following the public consultation held in late 2021 on proposed changes to the Malaysian Communications and Multimedia Content Code (“Content Code”), the Communications and Multimedia Content Forum of Malaysia has now issued the revamped version of the Content Code effective from 30 May 2022.

As part of the event, the General Consul of Ireland Anne-Marie Flynn and Ilka Hartmann, Managing Director of the British Chamber of Commerce, will give a lecture on “Brexit – Freedom or Frustration”.

Please note that this event will be held in German only.

The Regulator has responded to its September 2021 consultation on three draft policies relevant to how it will exercise its new anti-avoidance powers, which are intended to help protect defined benefit savings. The most recent policies follow on from the policy on the investigation and prosecution of the new criminal offences, which was published in September 2021 and provide further guidance on three specific areas: overlapping powers, the new GBP 1million civil penalty and information gathering. Separately, the Regulator has also issued a new consultation on two policies consolidating and updating certain existing policies on enforcement and prosecution.

The UK and international tax landscape has never been quiet for fund and asset managers (GPs) but a number of recent tax developments will have the potential to significantly affect how these businesses operate. Some of these developments will, however, be welcome by most GPs.

In April 2022, the Minister of Finance (MOF) issued MOF Regulation No. 26/PMK.010/2022 on the Stipulation of Goods Classification System and Imposition of Import Duty Tariffs on Imported Goods, which introduced changes made to the Harmonized Commodity Description and Coding System (HS) Code regime and updated Indonesia’s Customs Tariff Book (CTB). The CTB is amended every five years because the HS, on which it is based, is updated every five years to account for technological developments, changes in trade patterns, and the changing of global situations and conditions.