In brief

The pandemic-afflicted economic distress has given rise to significant uncertainty and potentially an increase in tax audits. Malaysia has had advance pricing arrangement (“APA“) rules since 2012. APAs provide certainty in terms of transfer pricing risk management on a prospective basis.

Recently, the Malaysian Inland Revenue Board (“MIRB“) has issued a set of guidance in the form of frequently asked questions (“FAQ“) with respect to the treatment of APAs in the COVID-19 pandemic landscape. We are pleased to share the key takeaways from the FAQ on APA Treatment below.

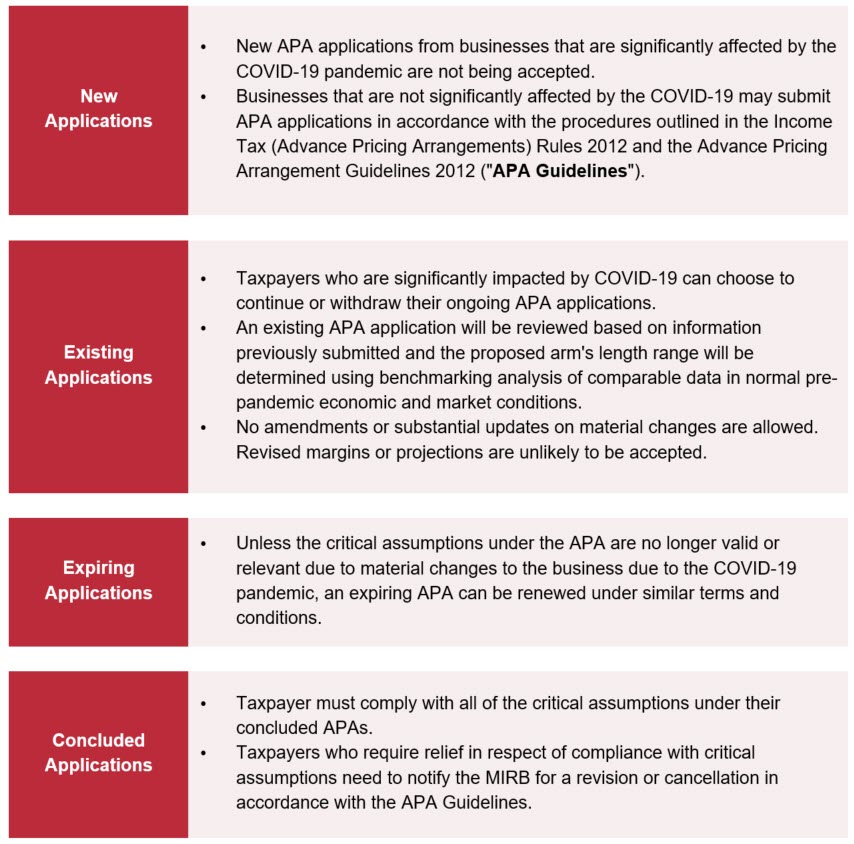

Key Takeaways from the FAQ

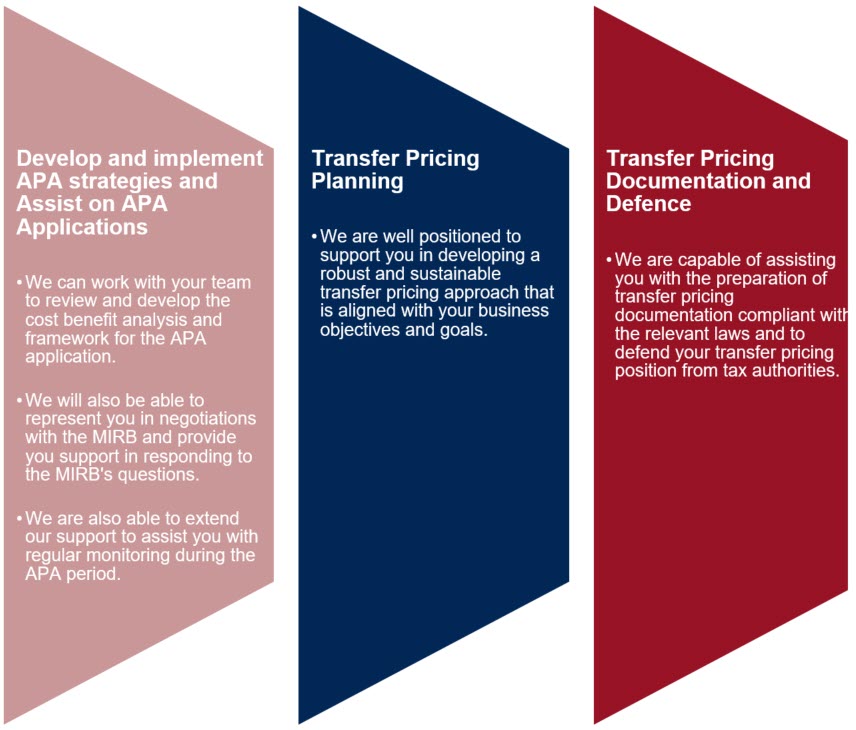

How We Can Help

In light of the FAQ, taxpayers may wish to assess the probability and significance of the economic impact caused by the COVID-19 pandemic on their businesses in considering their options moving forward.

We have a multi-faceted and multi-disciplinary team of transfer pricing practitioners who are economists and tax lawyers who are able to provide strategic advice and assistance in respect of the following:

- For taxpayers whose businesses remain resilient in the pandemic, it may be worth considering applying for an APA now despite the uncertainty and volatility, given that audits are currently on the rise. The APA can be refined in its later stages before conclusion when the full impact of the pandemic on the business can be ascertained.

- Taxpayers whose APA applications are pending conclusion may wish to consider if a withdrawal of their application is necessary, and in doing so, weigh the need for long-term certainty against the probability and level of pandemic-driven economic disruptions to their businesses.

- Finally, taxpayers with concluded and operating APAs should be mindful to ensure compliance with all critical assumptions under the same. Depending on the circumstances, taxpayers may wish to explore the options of renewal, revision or cancellation of the APA.

APAs

What is an APA?

Essentially, an APA is an agreement between a tax authority and a taxpayer which establishes the appropriate transfer pricing methodology/ies (“TPM“) to ascertain the arm’s length transfer prices of specified related party transactions between the taxpayer and its foreign affiliates over a certain period of time, under prescribed terms and conditions. There are three types of APA: unilateral, bilateral, and multilateral APA.

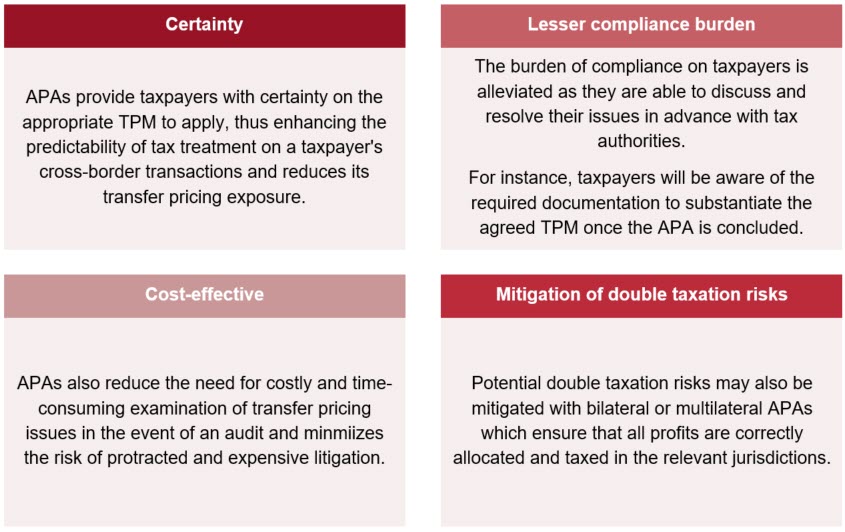

Benefits of APAs

Eligibility criteria

Generally, a taxpayer who carries on a cross-border transaction may apply to the MIRB for an APA. However, the MIRB will only consider the APA application if the following conditions are satisfied:

- the application is submitted by a taxpayer who is a company or permanent establishment assessable and chargeable to tax under the Malaysian Income Tax Act 1967, and has a turnover value exceeding RM 100 million;

- the proposed covered transaction relates to income that is chargeable and not exempted;

- the value of the proposed covered transaction meets the corresponding thresholds, as set out in the table below: