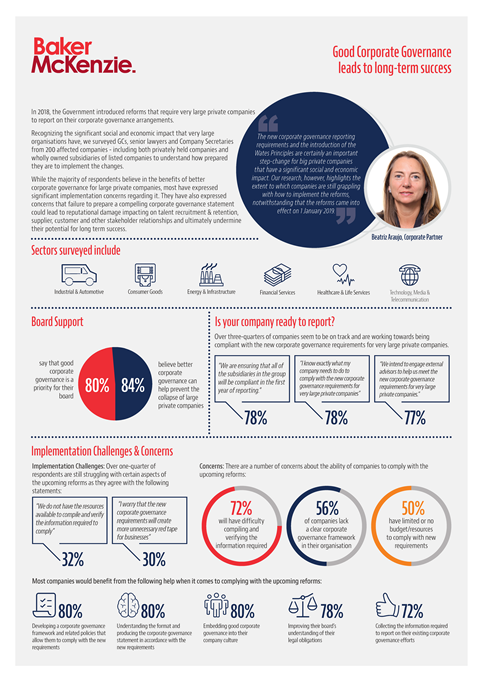

As Government reforms requiring very large private companies to report on their corporate governance arrangements come into force, over a quarter of the affected companies surveyed say that they are still struggling to implement the changes necessary to comply, with over half (56%) noting that they lack a clear corporate governance framework in their organisation. This is according to a survey by Baker McKenzie of 200 General Counsels, Inhouse lawyers and Company Secretaries of affected private UK companies with over 2,000 global employees and/or a global turnover of over £200 million and a global balance sheet total of over £2 billion.

Under new regulations introduced by the Government last year, very large private companies (including any wholly owned subsidiaries of listed entities that meet the qualifying thresholds) must include a corporate governance statement in their annual report. While all companies surveyed are aware of the new requirements and are working towards full compliance, most have expressed significant concerns about implementation.

Our research shows that 7 in 10 of companies surveyed (72%) say that they will have difficulty compiling and verifying the information required to comply, over half (56%) have a limited understanding of what is required to comply, including how to prepare a corporate governance statement, while 3 in 10 (32%) say that they do not have the resources available to compile the relevant information.

Budget constraints and time pressures are also huge concerns, with half (50%) of the respondents admitting that they have limited or no budget available and 30% worrying that the new requirements will create more unnecessary redtape for businesses.

Commenting, Beatriz Araújo, Corporate partner in Baker McKenzie’s London office, says: “We have seen notable examples in recent years of the huge impact that a lack of good corporate governance practices in large privately held companies can have. In less extreme cases, bad governance can lead to reputational damage impacting on talent recruitment and retention, supplier, customer and other stakeholder relationships, ultimately undermining a company’s potential for long term success. The new corporate governance reporting requirements are certainly an important step-change for big private companies that have a significant social and economic impact. Our research, however, highlights the extent to which companies are still grappling with how to implement the reforms.”

It is therefore reassuring that the majority of respondents believe in the benefits of better corporate governance, indeed 84% believe better corporate governance can help prevent the collapse of large private companies. This probably explains why there is significant interest in corporate governance issues at board level, with 80% of companies surveyed saying that good corporate governance is a priority for their board.

Baker McKenzie’s Corporate partner Jo Hewitt, says: “We know that good corporate governance is good business. Promoting positive behaviours can help restore and maintain confidence in big business and ultimately contribute to their long-term growth. Businesses should see this as an opportunity to analyse and test the way in which decisions are made in their organisations, both at the top and subsidiary levels, and ask for help where it is needed.”

Companies will need to work hard now to ensure, not only that they comply with the new reforms, but also that the corporate governance statement that they produce fully reflects their current corporate governance structures and practices, and aligns with their other disclosures, such as their Modern Slavery statement, Gender Pay Gap report and Payment Practices report. While 78% of respondents say that they know exactly what their company needs to do to comply with the new requirements, 77% intend to engage with external advisors to help meet the requirement to comply, whether that is to help them develop a clearer corporate governance framework, to understand and collect the information required to meet the reporting requirements, or to help them embed good corporate governance in their company culture.

The new reforms are only one part of the Government’s myriad of new reporting requirements for companies doing business in the UK. With its current consultation on the merits of introducing Ethnicity Pay Gap reporting, the Government is showing no signs of stopping with its corporate transparency agenda. With this in mind, companies should prepare themselves as best they can now to ensure that they are able to comply and produce a compelling corporate governance statement in 2020.

Click here to download infographic.