On 16 November 2018, the National Legislative Assembly (“NLA“) passed the Land and Building Tax Act (“Act“) after lengthy deliberation by the committees involved. It is expected that the Act will become effective once published in the Government Gazette, and tax collection under the Act will commence on 1 January 2020. This is intended to help taxpayers and the authorities come to terms with new real property tax regimes. The Act is set to replace the regressive and outdated tax under the Household and Land Tax Act, B.E. 2475 (1932), and Local Land Development Tax Act, B.E. 2508 (1965), and is designed to decrease income disparity, improve and encourage land use, increase efficiency in tax collection, and increase public revenue.

The significant changes under the Act include the change of the tax base from the yearly rent to the value of the land or buildings as appraised by the government. Furthermore, the collecting agent will now be the local Subdistrict Administrative Organization (“SAO“) for the subdistrict (tambon). The taxable properties under the Act are land, buildings, and condominium units.

Who are the taxable persons?

1. An individual or corporate land and building owner

2. A beneficiary to land and building owned by the Government

3. Any persons liable to pay tax on behalf of taxpayers under the Act

Different uses of the property

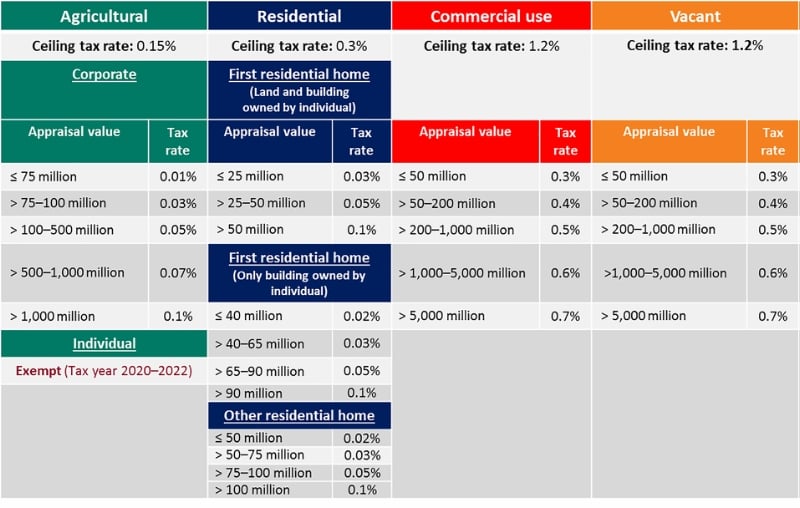

The tax rate will be different depending on how the property is used. Please note that more precise definitions of “residential” and “vacant” will be provided in later ministerial regulations.

Low applicable tax rates (Tax year 2020–2021)

To minimize the burden for taxpayers, the following rates will apply for the tax years 2020 and 2021.

Starting in tax year 2022, applicable tax rates that do not exceed the ceiling rates will be issued by way of royal decree. However, the Act allows each SAO to tax at a higher rate than under royal decree via local legislation, but these still cannot exceed the ceiling rates. In a letter issued by the Act’s drafting committee to the secretariat of the Cabinet (“Letter“), the committee suggested that before the lower-rate period ends in 2021, a royal decree should be issued so that taxpayers are aware of their future liabilities.

Tax relaxation for current property taxpayers

For tax years 2020–2022, the Act provides a tax relaxation for property that has been subject to property tax (either house and land tax or local development tax). This tax relaxation is only applicable if the land and building tax liable for tax years 2020–2022 is higher than the property tax liable for tax year 2019. This clause allows the current property taxpayers to pay property tax liable for tax year 2019 plus a portion of the additional tax which would be due owing to the land and building tax.

Please see the table below for calculation.

Tax mitigation deadline

Tax exemption for land and buildings used for certain purposes

The Act also provides a broad tax reduction clause (of up to 90% of tax) for reasons such as economic necessity or social context. Separate royal decrees are expected to affect these reductions.

In the NLA’s research report prepared before the Act was drafted, tax reductions were proposed for economic reasons on land and building tax for certain types of property i.e., property held by financial institutions, property located in special economic zones, and property used for public service.

Key takeaways

The Act provides that subordinate legislation must be issued within 120 days after the Act takes effect, and would allow a one-year period for the authorities to prepare for full implementation. We will keep you updated as subordinate legislation comes out.

In the Letter, it is also suggested that certain areas will need to be considered for tax exemptions for vacant land, such as remote areas or areas with aviation restrictions. Furthermore, the committee recommended a comprehensive electronic database for land use and government appraisal value.

For further information, please contact the team at Baker McKenzie.