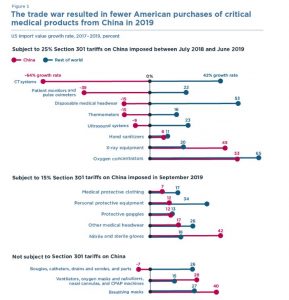

The Trump Administration has imposed tariffs on nearly $5 billion of US imports of medical products from China, which accounts for roughly 26 percent of all medical products imported from all countries. Facing potential supply shortages, the Administration published an announcement in the Federal Register on March 16, 2020, that it would exclude several Harmonized Tariff Schedule categories from the Section 301 duties to aid in the treatment of COVID-19. These exclusions cover products like certain types of disposable gloves and biohazard bags, and the exclusions will apply from September 24, 2018 through August 7, 2020. This comes at the same time as a related announcement that temporarily reduces these tariffs on other medical products and equipment from China, such as facemasks, gauze, latex gloves, and sanitizing wipes. These tariff exclusions or reductions are important and valuable, and importers of medical goods should ensure that they review the available exclusions and properly claim them, where available. Where the exclusions apply retroactively, importers should review their entries since September 2018 and prepare documentation to claim back duties paid or otherwise owed.

Kevin O'Brien is a partner in Washington, DC and former Chair of the North America Intellectual Property Practice Group. Mr. O'Brien has served as Co-Chair of the Patent Litigation Committee of the Federal Circuit Bar Association and has taught a course on Trade and Competition at Johns Hopkins University. He is currently Chair of the Trade Secrets Business Unit of the Global IPTech Group. He has more than 30 years of experience practicing in the areas of intellectual property and international trade law, with an emphasis on counseling and enforcement. Mr. O'Brien has been recognized as a leading lawyer by Chambers USA (District of Columbia) and has been selected as one of the "best lawyers" for IP law in Best Lawyers in America and in the Legal 500.

Christine Streatfeild is a partner in the IPTech Practice Group. She has a broad range of trade, regulatory, and litigation experience, most frequently representing clients in antidumping and countervailing duty cases, safeguard measures, duties imposed for national security purposes (Section 232 duties), and Section 337 intellectual property and trade secrets disputes. She appears before the US International Trade Commission (ITC), US Department of Commerce (DOC), and the federal courts. She also routinely advises companies regulated by the Food and Drug Administration (FDA) on issues affecting mergers, acquisitions, licensing, and compliance. Prior to joining Baker McKenzie, Ms. Streatfeild served as the acting deputy director of the Generalized System of Preferences (GSP) and in the Environment and Natural Resources division of the Office of the United States Trade Representative. She has also served as an adjunct professor at the Krieger School, Johns Hopkins University, where she taught Global Trade, Policy and Competition.

Tom Peele mainly handles trade regulatory matters such as antidumping and countervailing duty cases and litigation work involving foreign states and their agencies and instrumentalities. In addition to the Firm's Washington DC office, Mr. Peele also has experience working in Baker McKenzie's Beijing and Hong Kong offices. He has written a number of reports and articles for various publications on the law of foreign sovereign immunity and trade remedies. He was a Danforth Graduate Fellow and a Woodrow Wilson Fellow and the recipient of the Joseph R. Levenson Award in Chinese Studies.

Maleena Paal is an associate in Baker McKenzie's Intellectual Property and Technology Practice Group in Washington, DC. She represents both US and international clients on a wide range of intellectual property and trade remedy matters. Maleena began her career with Baker McKenzie as a summer associate, during which time she completed an International Clerkship in the Firm's London office. Currently, Maleena serves as the co-chair for the women's affinity group, BakerWomen.