On June 30th 2019, the EU and Vietnam signed the EU – Vietnam Free Trade Agreement (EVFTA) and the EU – Vietnam Investment Protection Agreement (EVIPA) in Hanoi. The EU and Vietnam began negotiations on the EVFTA in 2012 and expect the EVFTA may enter into force before the end of 2019.

What are the benefits of the Agreement?

The European Commission states that the agreement will include the removal of 99% of customs duties on exports. Vietnam’s tariff elimination schedule for goods imported from the EU will cover a period of 10 years, whereas EU tariffs applicable to Vietnam originating goods will be phased out over a period of 7 years.

The EVFTA will also open up market access for services between the parties. Importantly, Vietnam has committed to phasing out the Economic Needs Test (ENT) applicable to secondary and subsequent retail establishments, five years after entry into force. Accordingly, EU retail investors will enjoy streamlined access to the Vietnam market from 2025.1

Among other things, the EVFTA also includes an intellectual property chapter and liberalisation of public procurement as well as modern transparency, sustainable development and labor provisions.

When will it enter into force

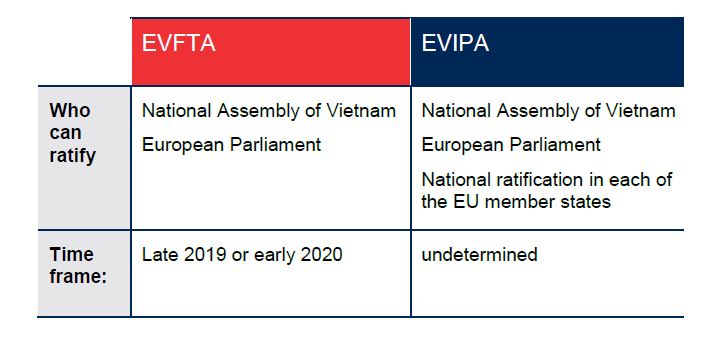

Both Agreements will enter into force following their respective ratification procedures. Entry into force will occur approximately 60 days after the parties have notified one another that they have completed their respective ratification procedures unless the parties agree on another date.2

The Agreements will follow different ratification procedures in the EU based upon a May 2017 European Court of Justice decision which required that certain provisions related to investments be ratified by each of the EU member states nationally (“Member Ratification Procedures“).3 Accordingly, since this ruling the EU has bifurcated trade agreements that engage Member Ratification Procedures.

The EVIPA will require Member Ratification Procedures, and will likely enter into force after the EVFTA. The EVIPA also allows for either the EU or Vietnam to propose provisional application of the Agreement.4 In such a situation, only the elements of the EVIPA which fall exclusively under the EU’s competences may be provisionally adopted, by agreement between Vietnam and the EU. This would allow some elements of the EVIPA to enter into force at an earlier date.

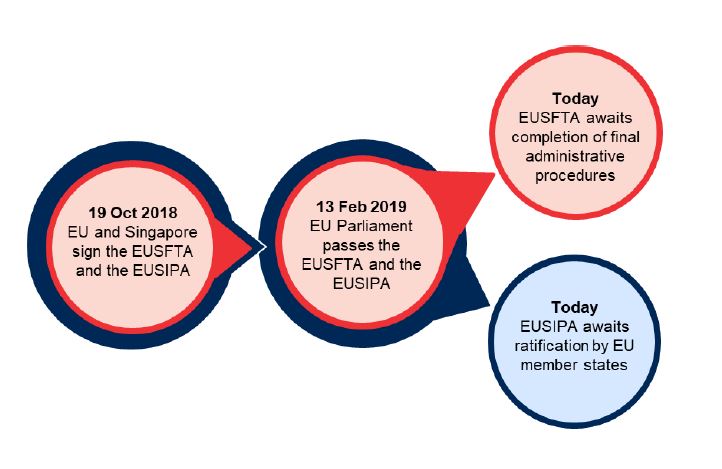

The European Union – Singapore Free Trade Agreement (EUSFTA) and the EU – Singapore Investment Protection Agreement (EUSIPA) provide a case study on how the EVFTA and EVIPA are likely to proceed. The EUSFTA was the first EU free trade agreement to be divided into a free trade agreement and investment protection agreement, in order to proceed with Member Ratification Procedures. Both agreements have already been ratified by the EU Parliament. The EUSFTA is awaiting entry into force following final administrative procedures, whereas the EUSIPA must be ratified by each EU member state, in addition to the regular ratification process.

1 Assuming 2020 entry into force.

2 EU – Vietnam Free Trade Agreement (EVFTA) art. 17.6; EU – Vietnam Investment Protection Agreement (EVIPA) art. 4.13

3 Opinion 2/15 of the Court, Opinion pursuant to Article 218(11) TFEU — Free Trade Agreement between the European Union and the Republic of Singapore, 2017, ECLI:EU:C:2017:376.

4 Supra note 2, EVIPA