Decree No. 281/2024

In brief

On 27 March 2024, Decree No. 281/2024 (“Decree“) was published in the Official Gazette. The Decree extends the deadline for repatriating financial assets of at least 5% of the total value of assets located abroad from 31 March 2024 to 30 April 2024, inclusive.

As a reminder, the applicable personal assets tax (PAT) rates for assets located abroad will be the same as those applicable to assets located in Argentina if, before 31 March of each year, taxpayers repatriate financial assets of at least 5% of the total value of assets located abroad and if certain additional requirements have been met.

In focus

The Decree was published in the Official Gazette on 27 March 2024, whereby the deadline for repatriating financial assets of at least 5% of the total value of assets located abroad was extended from 31 March 2024 to 30 April 2024, inclusive.

As a reminder, the PAT rates applicable to assets located abroad will be the same as those applicable to assets located in Argentina if, before 31 March of each year, taxpayers repatriate financial assets of at least 5% of the total value of assets located abroad. In this case, the tax rates corresponding to assets located in Argentina will be applicable to the extent that the following requirements have been met:

- The repatriated funds remain deposited in an account (a savings bank, current account, time deposit, etc.) opened in the name of its holder in Argentine financial institutions until 31 December of the year in which the repatriation was verified.

- The funds are sold in the single and free foreign exchange market, through the financial entity that received the funds from abroad.

- The acquisition of certificates of participation and/or debt securities of productive investment trusts set up by the Banco de Inversión y Comercio Exterior is recorded, provided that the investment remains under the ownership of the taxpayer until 31 December of the year in which the repatriation took place.

- The subscription or acquisition of shares of mutual funds that comply with the requirements of the National Securities Commission (CNV) is recorded, provided that the mutual funds remain under the ownership of the taxpayer until 31 December of the year in which the repatriation took place.

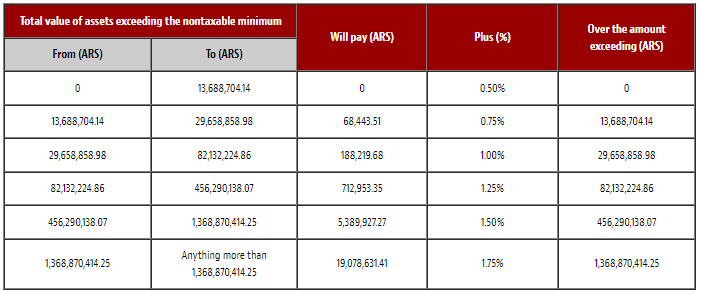

As a reminder, the tax rates applicable to assets located in Argentina are as follows:

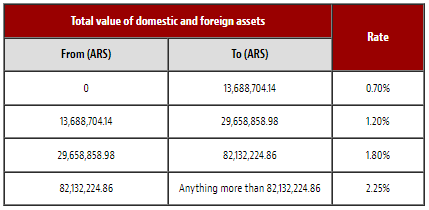

Likewise, the applicable tax rates on assets located abroad are as follows:

To read the Spanish version, please click here.