In brief

On 12 March 2024, the Australian Government released exposure draft legislation on Buy Now, Pay Later products (BNPLs) for public consultation. This follows the Government’s previous consultation on the regulatory framework for BNPLs, and growing calls to regulate the BNPL industry in order that these products might have similar or the same protections that exist for consumer credit products in Australia.

The reforms have been driven by Government concerns relating to unaffordable lending practices, unsatisfactory complaint resolution and hardship assistance, the charging of excessive late payment fees, and a lack of transparency surrounding product disclosures and warnings.

In Australia, while BNPL structures vary, they have historically operated within an exempt space of credit regulation due to their low cost, short term credit model. The Treasury Laws Amendment Bill 2024: Buy now, pay later (the Amendment Bill) proposes to extend the scope of the National Consumer Credit Protection Act 2009 (Cth) (the Credit Act) and National Credit Code (the Credit Code) to regulate Low Cost Credit Contracts (LCCCs). The Amendment Act expressly includes a BNPL contract as a type of LCCC.

Key takeaways

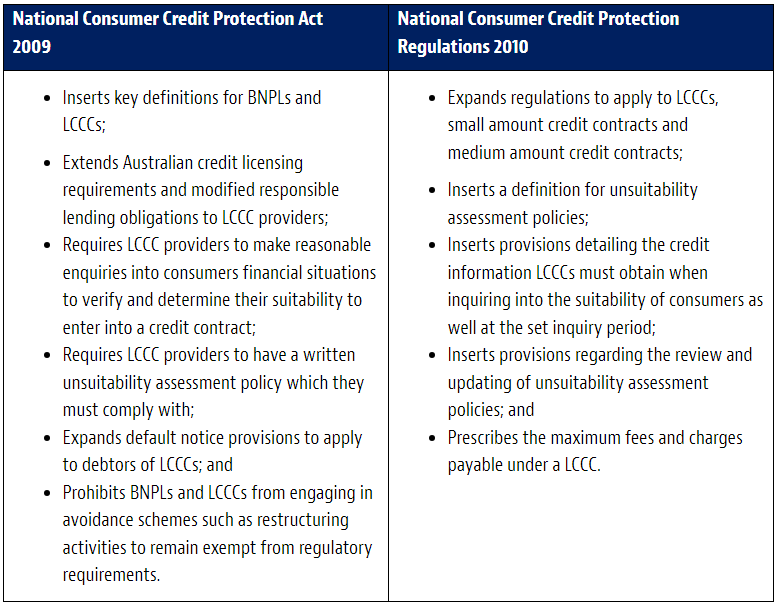

As stated in the Explanatory Memorandum, the objective of the Amendment Bill is to regulate LCCCs by bringing them within the scope of the Credit Act and the Credit Code. The regulatory framework envisaged by the Amendment Bill is therefore set to apply to BNPL arrangements, as well as other future classes of LCCC (e.g., wage advances). The Amendment Bill proposes to make the following amendments to the Credit Act and Credit Code:

In more detail

New Definitions

The Bill provides legislative definitions for LCCCs and BNPLs. These definitions have been kept purposely broad so as to encompass future classes of LCCC, or those prescribed by the National Consumer Credit Protection Regulations 2010 (Cth) (the Credit Regulations).

The Bill classifies LCCCs as contracts:

- where credit is, or may be provided;

- BNPL contracts, or contracts prescribed by the regulations;

- contracts in which credit is provided for no longer than a period prescribed by the regulations ; and

- contracts that satisfy the specified fees and charges payable under LCCC contracts (being a maximum of A$200 for a 12-month contract and A$125 for any later 12-month period during which the contract is in effect).

BNPL contracts are separately defined as contracts which form part of a BNPL arrangement involving a retail client, a BNPL provider and a merchant.

The Bill defines a BNPL arrangement as an arrangement or a series of arrangements under which:

- a merchant supplies goods or services to a retail client;

- a BNPL provider directly or indirectly pays the merchant an amount that is some or all of the price for this supply; and

- there is a contract between the BNPL provider and the retail client under which the BNPL provider provides credit to the retail client in connection with that supply.

The Amendment Bill further states in relation to these BNPL arrangements that:

- it does not matter whether any fees or charges are payable by the retail client or the merchant in connection with the arrangement or series of arrangements;

- it does not matter whether the payment by the BNPL provider occurs before, at or after the time when the goods or services are supplied by the merchant to the retail client;

- it does not matter whether the contract is a continuing credit contract; and

- it is not necessary for the arrangement or series of arrangements to include any contract to which the merchant, retail client and BNPL provider are all parties.

The Credit Code will apply to LCCCs with minor modifications, including that LCCC providers will be permitted to prompt consumers to increase their credit limit.

Licensing

LCCC providers will be subject to the licensing requirements in Chapter 2 of the Credit Act. They will be required to hold and maintain an Australian credit licence (ACL) and comply with the relevant licensing requirements and licensee obligations.

To the extent an LCCC provider already holds an ACL, they may be required to apply for a variation of the authority under their licence to cover the provision of LCCCs under the Credit Act.

Where the provision of credit satisfies the requirements for LCCCs, and could also be characterised as credit provided under a small amount credit contract or a medium amount credit contract, the credit contract in question is proposed to be regulated as an LCCC only.

Credit Representatives

Under the proposals, credit representatives of LCCC providers will not be required to meet requirements relating to sub-authorisation and associated reporting, credit guide provision and AFCA membership unless they are engaging in debt collection activities.

Responsible Lending Obligations

Licensees that are LCCC providers are to be subject to a modified version of the existing responsible lending obligations (RLOs). This will require LCCC providers to assess whether entering into a credit contract or increasing a consumer’s credit limit would be unsuitable for the consumer. In addition, should the LCCC provider enter into a contract with a consumer for A$2,000 or more, this is deemed to be a “larger contract” and the LCCC provider must also seek to obtain consumer credit information from a credit reporting body. The credit information includes the following within the meaning of the Privacy Act 1988 (Cth) – identification information, details of information requests made in relation to the individual, default information, payment information, personal insolvency information, new arrangement information and court proceeding information.

The modified RLOs will also require LCCC providers to take appropriate and proportionate steps to assess the suitability of lending. LCCCs will be required to have a written policy containing specific matters and regularly review their RLO policies and procedures. LCCCs can choose to comply with the bespoke RLO framework for LCCCs or with the existing responsible lending requirements under the Credit Act. If firms are already offering consumer credit products, this means they can use a common responsible lending process for both these products and the LCCC products.

Breaches of the RLOs are to be considered breaches of the credit licensee obligations. Remedies will include cancellation or suspension of the licence.

Looking Ahead

The Amendment Bill represents a key step forward in the regulation of BNPLs. The public consultation period for the Amendment Bill is open until 9 April 2024 with the final Bill expected to be introduced later this year. Across the pond, the New Zealand government have already approved BNPL regulations which will come into effect from 2 September 2024.

In the meantime, BNPL providers should ensure they are across these proposed changes, particularly on how to structure their current customer onboarding procedures in order to assess the suitability of the BNLP product for customers (including preparing an unsuitability assessment policy) as well as assess whether or not they need to apply for an ACL or a variation to their existing ACL with ASIC. Moreover, BNPL providers who have not previously operated within an Australian regulatory licensed framework will need to consider how they will comply with the relevant ACL requirements and other licensee obligations going forward including whether they have adequate human, financial and IT resources.