Managing the risks and uncertainties

Contingent workforce and flexible working continue to be a dominant issue in the current employment landscape. The laws in this area are still evolving, as governments adapt to modern workforce models, which companies are increasingly engaging with in order to help “futureproof” their businesses.

Recognizing this issue, our multipractice team of industry specialists have come together to provide resources that guide organizations through essential considerations and risks that come with these flexible working models and less traditional forms of worker engagement.

This multijurisdictional, interactive map and comparison tool highlights various areas of risk that companies should be considering when engaging contingent workers, covering employment, tax, employee benefits and pensions.

Interactive Contingent Worker Misclassification Risk Comparison Tool

As ways of working and engaging individuals changes, companies must navigate and stay up to date with changing rules as to how these individuals should be treated. This tool seeks to highlight the main issues companies should be aware of across a range of different areas.

The tool is made up of two sections:

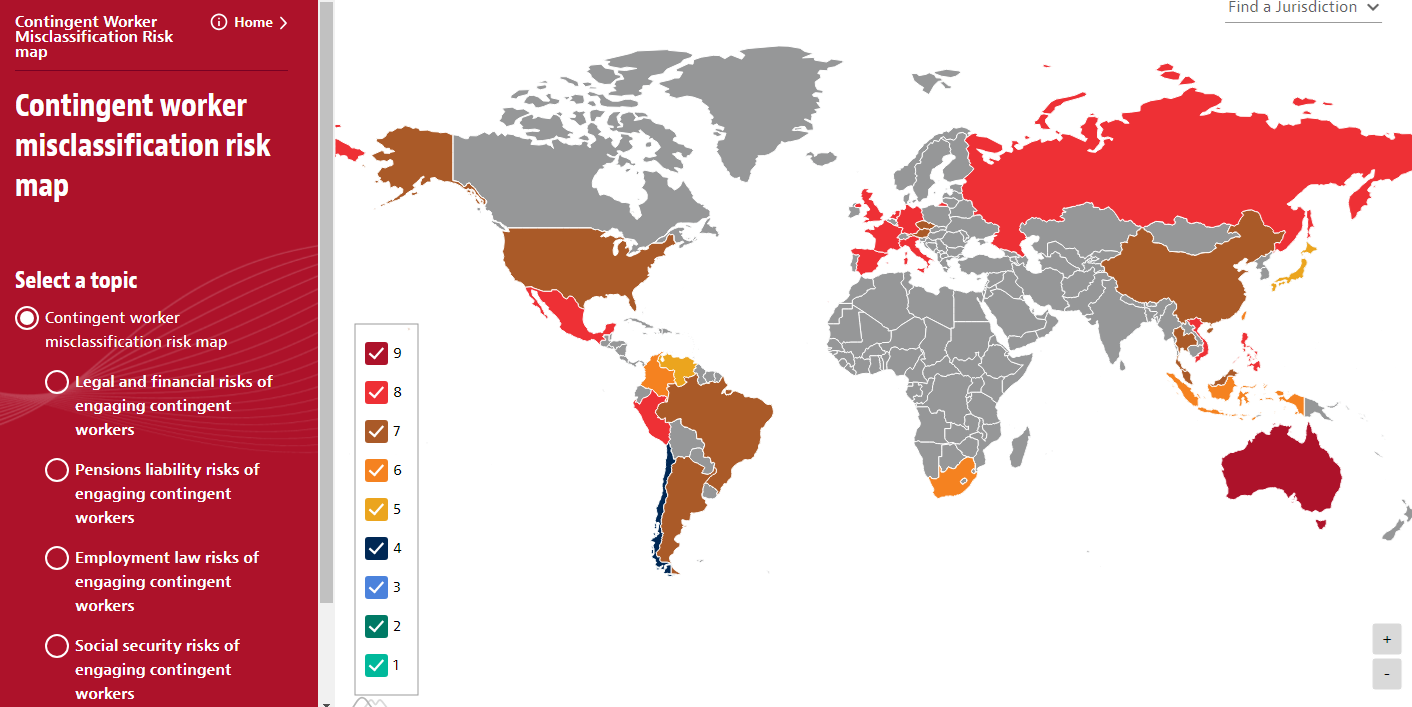

- The Contingent Worker Misclassification Risk Comparison Tool, which provides high-level information about pensions, wage tax, employment law and employee benefits risks of engaging contingent workers across 29 jurisdictions

- The Contingent Worker Misclassification Risk Map, which provides high-level information and risk ratings across 29 jurisdictions

To find out more about the comparison tool and how to use it, click the image below.

Contingent Worker Misclassification Risk Map

Click on the Contingent Worker Misclassification Risk Map image below to navigate to the interactive map page.

Please note that although the contents on this website is a helpful source of information, we recommend using these materials for reference only, and not as a substitute for obtaining detailed employment and/or tax advice. For professional advice and assistance, please contact your usual Baker McKenzie contact.