In brief

The Government of Malaysia had on 15 April 2024 announced that it will establish an Energy Exchange Malaysia (“ENEGEM“) to facilitate cross-border sales of green electricity to neighbouring countries, namely Singapore and Thailand (“CBES RE Scheme“). The ENEGEM platform will implement cross-border energy sales based on the latest Guide for Cross-Border Electricity Sales (CBES) issued by the Energy Commission of Malaysia (“Energy Commission“).

Contents

Initial auction

The Ministry of Energy Transition and Water Transformation (“PETRA“) is inviting interested parties to participate in the inaugural auction for purchasing green electricity from Malaysia’s supply system, to be supplied to Singapore via the ENEGEM platform. The auction will begin with a 100 MW pilot run, utilizing the existing interconnection between Singapore and Peninsular Malaysia.

The existing power interconnection between Malaysia and Singapore was upgraded in 2022 allowing for bidirectional electricity flows of approximately 1,000 MW between the two countries. The existing interconnector now facilitates cross-border power trade, contributing to the broader ASEAN Power Grid objective. Additionally, it has enabled up to 100 MW of hydropower from Laos to be exported to Singapore via the Thailand and Malaysia grids since June 2022.

Key features of the forthcoming auction for the purchase of green electricity are as follows:

a. The pilot scheme will be open to renewable energy bidders (“RE Bidders“) who hold electricity generation and/or retailer licenses for the Singapore Electricity Market.

b. Interested RE Bidders must register with the Single Buyer to participate in the auction.

c. After the qualification process, successful applicants will be notified to proceed with the auction to purchase green electricity on the auction day.

d. Winning RE Bidders will enter into an RE Supply Agreement with the Single Buyer for the sales and purchase of green electricity.

Interested parties can register their interest to participate in the CBES RE Scheme with the Single Buyer at www.singlebuyer.com.my.

Overview of the CBES RE scheme

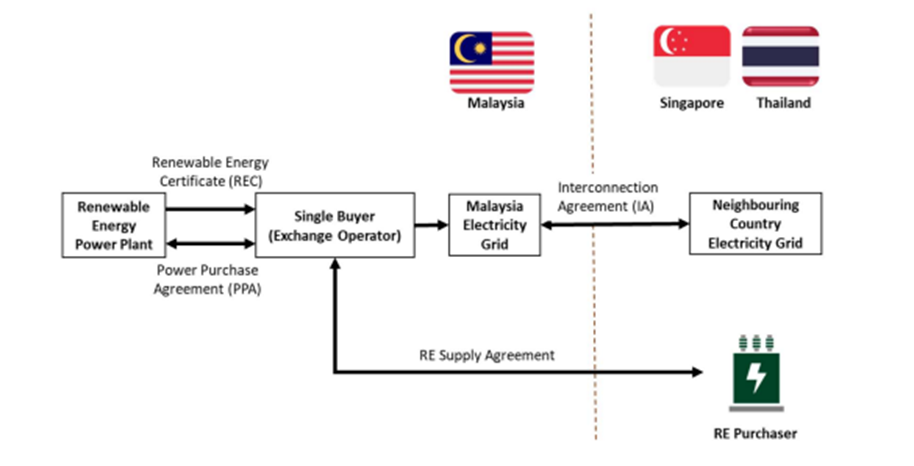

The CBES RE Scheme is summarized below:

The CBES RE Scheme operates through the ENEGEM platform. The Single Buyer manages this platform and serves as both the verifier of green attributes and the issuer of Renewable Energy Certificates (RECs) associated with cross-border electricity trading. The Single Buyer and the RE Purchaser must enter into an RE Supply Agreement for the sale and purchase of green electricity.

The source of green electricity includes solar and hydro plants, as well as other renewable sources approved by the Energy Commission. The green electricity sold under the CBES RE Scheme is fulfilled through physical delivery of committed MWh and associated RECs. The RE Purchasers’ final consumers will redeem the green attributes of the RE sold through the ENEGEM platform, following the terms of the RE Supply Agreement.

The existing interconnection between Peninsular Malaysia and its neighbouring countries (up to 300MW for Singapore, and subject to availability for Thailand) is utilized for the CBES RE Scheme.

The interested RE Bidder must register with the ENEGEM platform and comply with the registration and auction process. As part of the auction requirements, the RE Bidder may need to provide a commitment bond, determined by the Single Buyer based on the invitation to bid documents. The RE Purchaser is responsible for covering various financial obligations, including taxes, duties, and other charges.

The charges for the supply of the green electricity includes, but is not limited to, the energy price, RECs, grid services, transaction fees, and contribution to the fund set up by the Malaysian Government to facilitate energy transition.

Conclusion

The ENEGEM has been hugely anticipated by the industry and certainly comes at an opportune moment when the need for renewable energy is in high demand. This initiative is also part of the Malaysian Government’s efforts to enhance Malaysia’s cross-border electricity integration framework and to foster greater renewable energy development and regional cooperation in cross-border energy trading among ASEAN countries.

This is also an exciting development from Singapore electricity import perspective. As things stand now, if the electricity supply are coming from existing TNB’s and LSS renewable energy projects, it is unlikely that such electricity imports will fit into EMA’s 4 GW import tender. That said, the near term availability of such renewable energy import from Malaysia will be helpful to meet renewable energy / RECs demand, in particular with respect to data center operators in Singapore. There is existing electricity import regulatory regime which has been successfully applied via YTL PowerSeraya as the importer for a 100 MW trial from Peninsular Malaysia, hence, there should not be regulatory impediments to the import from a Singapore standpoint. The key to speedy implementation lies in the tender requirements, contractual terms with the Single Buyer and the applicable charges. We will be following closely on the forthcoming auction that will be run by ENEGEM.

* * * * *

© 2024 Wong & Partners. All rights reserved. Wong & Partners, member of Baker & McKenzie International. This may qualify as “Attorney Advertising” requiring notice in some jurisdictions. Prior results do not guarantee a similar outcome.